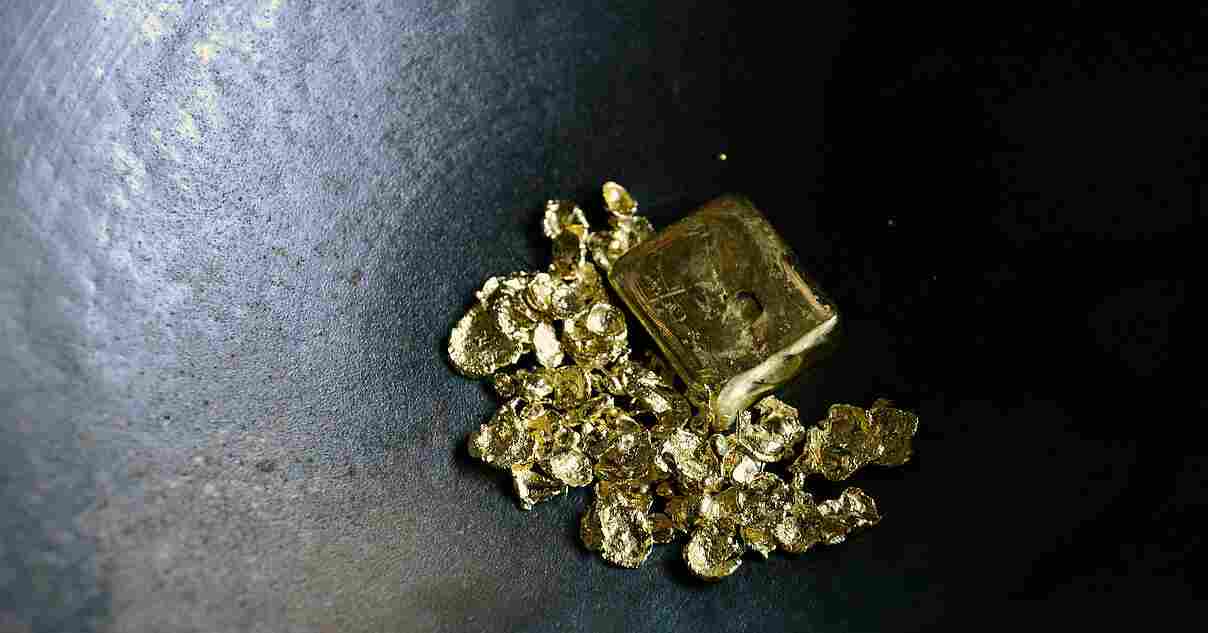

New York, United States (Enmaeya News) — Gold prices surged to a new record high Monday, with spot prices approaching $3,610 per troy ounce, fueled by expectations of a U.S. Federal Reserve interest rate cut following weaker-than-expected August jobs data.

The rally marks a continuation of a broader upward trend, with gold prices rising 37% in 2025, following a 27% increase in 2024, driven in part by central bank demand—particularly from China—and global economic uncertainty. Reuters

Analysts suggest that if private investors increase their allocation to gold, prices could surge well above $4,000 per troy ounce by mid-2026, according to Goldman Sachs. Reuters

Investors also tracked gold-backed exchange-traded funds. SPDR Gold Shares (GLD) traded at $331.05, while iShares Gold Trust (IAU) and abrdn Physical Gold Shares (SGOL) closed at $67.76 and $34.28, respectively. Prices fluctuated during intraday trading, reflecting volatile market sentiment.

Analysts said the gold rally reflects investors’ ongoing demand for safe-haven assets amid economic uncertainty and anticipation of policy shifts by central banks.

Gold remains under pressure from market volatility but continues to draw attention from investors seeking protection against inflation and geopolitical risks.