Lebanon (Enmaeya News) – January 7, 2026

Economy Minister Amer Bassat confirmed that the Central Bank of Lebanon is capable of supporting a plan to repay the majority of depositors whose funds have been frozen for years.

In an interview with Bloomberg TV, he noted that there is sufficient liquidity to avoid limiting repayments to "small depositors" only, and that "large depositors" could also be included, supported by the returns on the Central Bank’s assets.

He described the program as providing a "fair and objective" path for small depositors, and a "transparent and clear" approach for large depositors.

The minister also pointed to a slowdown in inflation over the past two years, while it remains around 15%.

He highlighted the challenges of negotiations with the International Monetary Fund (IMF) and bondholders, as well as concerns over the potential collapse of the ceasefire agreement.

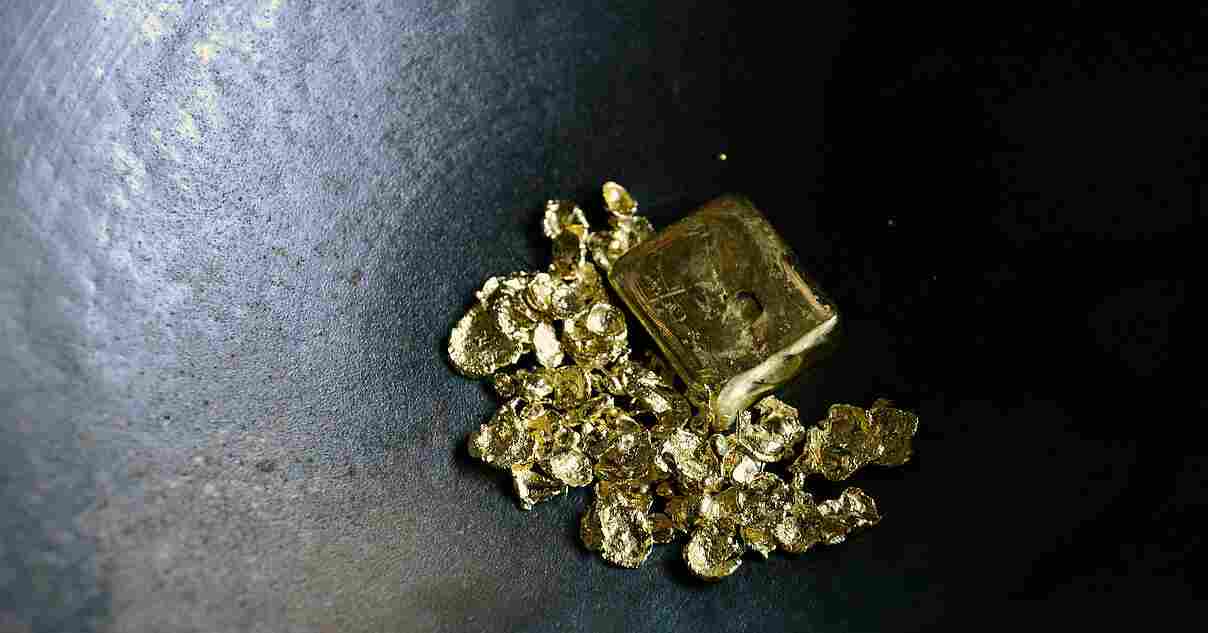

Despite these challenges, he expressed confidence in the government’s and the Central Bank’s ability to implement the plan, emphasizing that the bank holds "relatively large assets" and will not need to sell its gold reserves.

He noted that the value of these reserves is estimated at $40 billion as of December 15, according to Central Bank data, which strengthens "asset holders’ confidence”.

According to Bassat, the authorities have reached a "fair distribution" of losses between the Central Bank, local lenders, and depositors, with the government also contributing.

The draft law provides for funding cash payments to small depositors through the Central Bank and local banks.

The minister added: "The article recalls that the crisis erupted in 2019 with the halt of inflows from abroad and the collapse of the currency peg to the dollar.

He concluded: "The Central Bank was unable to repay commercial lenders nearly $80 billion, which triggered an ongoing confrontation accompanied by actual banking restrictions and social deterioration, exacerbated by the COVID-19 pandemic”.